An enhanced BPAY Solution

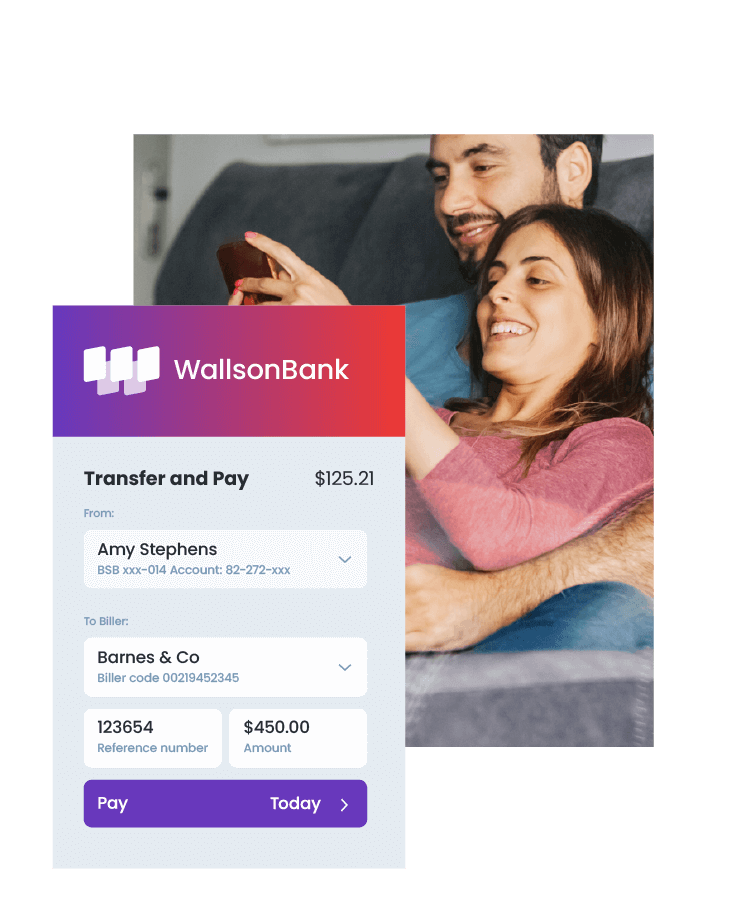

Accept BPAY Payin for customers who want to pay through their online banking portal - BPAY payments can be made with more than 150 financial institutions and dedicated biller codes make it easy to identify customer payments.

Confirm customer payments sooner with API driven BPAY that provides up to 3 payment notifications per day. Early notifications add certainty that the payment has been made and is on its way.

With BPAY payout, provide customers the convenience to make bill payments directly from your app or website to 45,000 to 60,000 billers.

.jpg?width=1281&height=1618&name=BPAY_4b%20(1).jpg)

.png?width=511&height=462&name=Customer%20(1).png)

-1.png?width=75&height=68&name=Customer%20(1)-1.png)