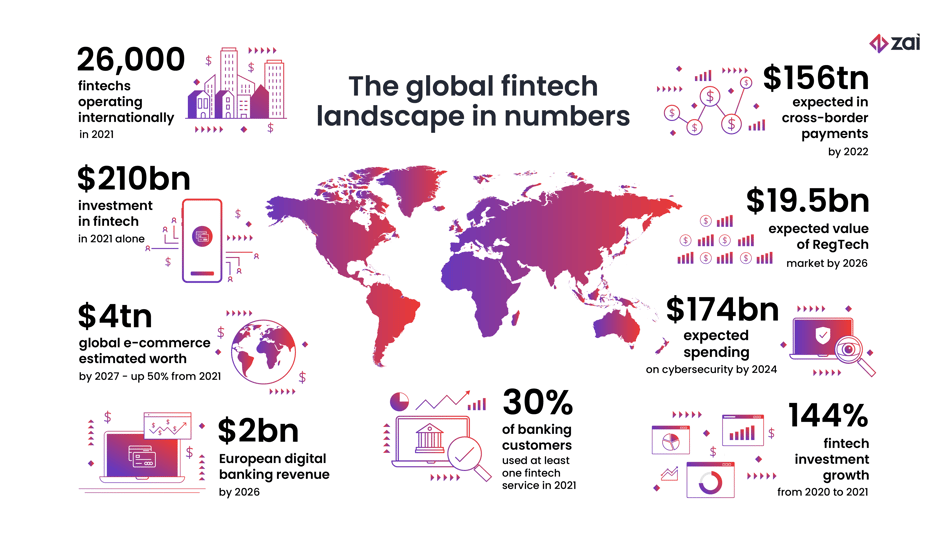

What new opportunities will financial technology (fintech) open up in the next few years? Given the level of investment and success recorded to date, we can predict with confidence that fintech will play a critical role in refining financial services, payments and online security. More than 26,000 fintech companies operated globally in 2021 and worldwide investment topped $210bn. As the fintech sector matures further, and evolves from a disruptive to established technology, there’s good reason to believe that the trends outlined here will shape the sector in 2023 and beyond.

The relentless rise of digital channels

Global e-commerce will be worth $4tn by 2027, representing a 50% increase from 2021. Unforeseen events have certainly shaped the shift — e-commerce recorded a decade’s growth during three months of the pandemic alone — and transformed the context of customer behaviour. Yet fintech has driven consumer change too, and will continue to do so. Digital banking is already used by two-thirds of Americans (although the degree of use varies sharply) and European digital banking revenue is expected to stand at $2bn by 2026.

Key takeaway: with mobile devices replacing in-branch/store interaction, customer experience has reached thumb level and the demand is huge for innovative fintechs who can make transactions or enquiries frictionless, secure and even fun.

Cloud banking gathers momentum

From 2023 onwards, expect to see fewer articles lamenting the internal legacy challenges banks face in their digital transformation journey, and more announcements that celebrate a banking sector reborn via the cloud. For now, a surprisingly small proportion (just 12% in North America) of banking tasks take place in the cloud, but that could double in the next two years. Fintechs are helping banks to make their systems faster, more nimble and more responsive, and while the banking app won’t replace the physical branch, hosting data in the cloud will continue to unfetter banks to:

-

Introduce new features quickly.

-

Unleash machine learning (ML) to detect anomalies and beat fraud.

-

Phase out cash and physical cards in favour of virtual cards secured with robust biometric technology.

Key takeaway: customer experience is the big battleground. The ability to bank or shop across devices, and to access services on demand is now a right, not a perk.

Embedded finance adds convenience

As more businesses partner with banks to offer financial products and services, the landscape will continue to diversify and democratise through embedded finance. In short, consumers can look forward to even more opportunities to access features that were traditionally bank-operated (eg. loans and payments) without having to leave the non-banking platform they’re using, such as:

-

Multi-currency wallets for travel.

-

Buy Now, Pay Later credit services for e-commerce.

-

Loyalty rewards, either as cash or tokens.

Embedded finance is the consumer-facing, front-end counterpart to Banking as a Service (BaaS), which focuses more on the provision of banking licences to third parties. Thanks to the proliferation of application programming interfaces (APIs) that allow businesses and banks to bolt on functionality without having to re-engineer core systems, the speed and convenience of shopping and banking will remain on a steadily upward trajectory. Some 30% of banking customers use at least one service provided by a fintech.

Key takeaway: to remain competitive, banks will continue to evolve into service providers for non-banking institutions.

Big Tech and fintech crossover

It’s not just traditional banks who are focusing on fintech. Big Tech has some substantial plans too, with Amazon, Apple, Google and Facebook each either exploring opportunities for creating their own digital currencies, or refining their banking and lending capabilities. Global fintech investment grew by 144% from 2020 to 2021, and a sizeable proportion comes from the Big Tech giants. Their intention isn't to replace banks, however. Their goal is to acquire users, and thus data, which can then be aggregated, repackaged and resold. Partner fintechs can then provide the data organisation, predictive analytics and personalisation that ultimately improves customer retention and lifetime value.

Key takeaway: it’s not the gold reserves in the vault that matter, but the customer data in the server warehouses.

Virtual spaces become reality

Virtual reality (VR) will be a $80bn industry by 2025, yet there’s still a debate about its relevance beyond gaming and entertainment. However, fintechs could play a crucial part in expanding the reach of VR, as well as augmented reality (AR), to e-commerce, banking, real estate, and more. This VR vision embraces 24 hour banking from any location, and lowers operating costs thanks to not having to maintain physical channels. With innovations in facial recognition and multi-factor authentication, VR promises secure, immersive financial services that break through traditional limitations (e.g.. opening hours, holidays) and open up new markets.

Key takeaway: the very meaning of customer experience is up for grabs and the most innovative fintechs have an opportunity to revolutionise traditional services.

Blockchain builds

Resist the temptation to focus immediately on cryptocurrency, whose combined value plummeted by $1tn in early 2022, and take a broader perspective of blockchain to remember that Web3 technology will be worth ten times more ($39 billion) by 2025. Distributed ledger technology, and with it the world of decentralised finance (DeFi) and non-fungible tokens (NFTs), has broken through into the mainstream. Consumers do not need to understand the stubbornly complex mechanics of blockchain to unlock the benefits in the form of easier cross-border and peer-to-peer payments, better fraud resilience, and less human error in transactions. A recent Deloitte survey found that 76% of executives expect blockchain to replace fiat currencies within the decade.

Key takeaway: behind the scenes, there’s an alternative approach building for authorising and making payments and storing assets securely that falls outside conventional controls.

Intelligent automation

A recurring complaint in the banking sector in particular, but relevant to any large organisation that has to store and process large volumes of transaction or customer data, is the strain on resources of managing that data. Step forward robotic process automation (RPA), and machine learning (ML), both areas in which fintech providers are investing heavily, to free up staff for tasks that can deliver more business value. From payment processing to customer onboarding, smart AI-powered investment advice to chatbots, fintechs are helping businesses automate menial, repetitive tasks that carry little value, eliminate human error, and deliver a consistent, transparent, and on-demand service to customers.

Key takeaway: from automation of manual processes, expect the wheel to come full circle in 2023 and beyond as fintechs deliver better technology for humanising automated features, especially when it comes to the quality of chatbots.

Managing compliance with regulatory technology or RegTech

Financial institutions need to invest yet more time and resources in compliance as data graduates to the cloud and consumer attitudes to third-party sharing and tracking reject one-size-fits-all policies. RegTech can at least make complex processes more simple, supporting automation, advanced biometric authentication, cryptography and more. Indeed, the RegTech market will be worth $19.5bn by 2026. Any opportunity to meet compliance requirements is also an invitation to deliver a better customer experience. In this sense, fintech providers will allow businesses to deploy RegTech for the following:

-

Monitor data security and flag potential fraud.

-

Accelerate onboarding and other processes through automation.

-

Offer better transparency (and lower fees) through smart contracts.

-

Drive sustainable activity by supporting businesses in meeting their environmental, social and governance (ESG) targets.

Key takeaway: the compliance and regulatory burden on businesses is unlikely to ease, so investment in RegTech becomes a priority we can safely mark as “urgent” from 2023, if not earlier.

Cybersecurity matters

Whenever organisations outline their vision for digital transformation, there’s an elephant in the room — and it cost the global economy $6tn in 2021. Fraud is an unavoidable feature of digital financial services, which is why worldwide cybersecurity spending is expected to reach $174bn by 2024. It’s not just businesses and customers who are energised and inspired by the shift to digital. Cybercriminals too, see an unparalleled opportunity to unleash data breaches, ransomware, or phishing attacks.

Key takeaway: With the expansion of open banking, enhanced security becomes the new standard.

Emerging markets come onboard

Given that there are still some 1.6bn people worldwide who are defined as “unbanked”, fintech is poised to extend services to those whom traditional financial service providers have overlooked, whether because of compliance or regulation issues or simply revenue projections. The mobile phone has liberated both banking and e-commerce, allowing payment and microfinance options in emerging markets that will continue to grow at a furious pace beyond 2023. Cross-border payments are growing by roughly 5% per year and are expected to top $156tn in 2022. The adoption of fintech services in sub-Saharan Africa, the Middle East, India and China will continue to drive participation in a truly globalised marketplace.

Key takeaway: fintechs have unprecedented opportunities for developing and scaling a service, but the need to customise for local markets will temper the speed of growth.

Greater use of sensors and Internet of Things (IoT)

Pointing out that the Internet of Things (IoT) is now a permanent feature in banking and e-commerce hardly counts as trend-spotting. After all, the automatic teller machine (ATM) is essentially an IoT device, and the first one made its debut in 1969. However, the extent to which IoT in the form of wearable tech, mobile point-of-sale, voice-activated assistants, and so on, will become the standard beyond 2023 is hard to understate. That rise tallies with the interest of Big Tech in fintech that we have already explored. From a consumer perspective, these smart technologies will simply deliver smoother, swifter and more secure services that are “always on”. For businesses, the relentless stream of data collected can be applied to better forecasting and personalisation and more robust security.

Key takeaway: obtaining initial consent from a customer may be harder, and transparency is key, but for younger generations in particular, they will share data freely, provided there's a fair exchange in value.

We’ve shared our take on fintech trends beyond 2022. Now discover how Zai is at the forefront of shaping the future. Zai’s innovative API helps your organisation keep pace with the rapid changes that are transforming business - from automating the onboarding experience to simplifying multi-party workflows.

To find out more, contact our sales team today.

.png?width=211&height=299&name=cover%20(9).png)