If you’re a tech company in Australia looking to grow, you may be struggling to understand how to design a payment system that helps you scale. Chances are your current payment flow to capture and manage customer funds is impacting your plans by:

-

Making reconciliation and operations difficult because you have multiple payment providers to consolidate

-

Forcing your finance teams to manually process many parts of your customers’ payment flows

-

Requiring your tech team to focus a considerable amount of their time on payment plumbing instead of on your customers’ payment experience.

-

Slowing down your ability to capture revenue, which in turn ripples through the rest of your processes

By themselves, these pain points create considerable headaches for product teams, developers, and the finance department alike. Combined, they can slow down or even derail your ambitious growth plans.

We wrote this article to help you understand how to design complex payment flows to accelerate your growth and free your workforce to focus on value-adding tasks. We’ll cover:

-

3 mistakes to avoid when designing and implementing complex payment flows

-

How Zai helped a growing Australian B2B marketplace conquer their payment system needs

Want to know how to design a better payment system for your growing business? We can help. Contact us now to get the conversation started.

How to design complex payment flows with Zai

Here at Zai, we have over a decade of experience creating complex payment flows for some of the fastest-growing online platforms in Australia. Our RESTful API sits at the core of our payment flow designs, which lets customers connect to our full suite of payment APIs and data and reconciliation tools. Combined with our payment-system design experts, we can build comprehensive and bespoke payment flow solutions that scale. Here’s how we do it.

1. We learn about your current payment state

After reaching out to us, we’ll set up a discovery call with your experts and ask questions to learn more about your current payment ecosystem, including:

-

Where and how you capture payment requests.

-

What you need the funds to do once they’re in your system.

-

How you reconcile these movements and keep track of your customer’s funds.

-

How the funds leave your platform.

This information gives us what we need to both see if we’re a good fit and to begin thinking about how we can work together. If that’s the case, we move on to the next step.

2. We deep dive into your ideal payment flow system

Once we understand your needs and current situation better, we’ll start to dive deeper. That begins with a call with your tech and product leads and our payment solution consultants. Our goal at this stage is to learn what your ideal payment flow design looks like.

From there, we’ll get to work building a proposal based on our product suite and your needs. At the same time, we give you and your developers access to our sandbox and docs so you can get familiar with our tech.

3. We draft a payment flow solution custom-made for your business model

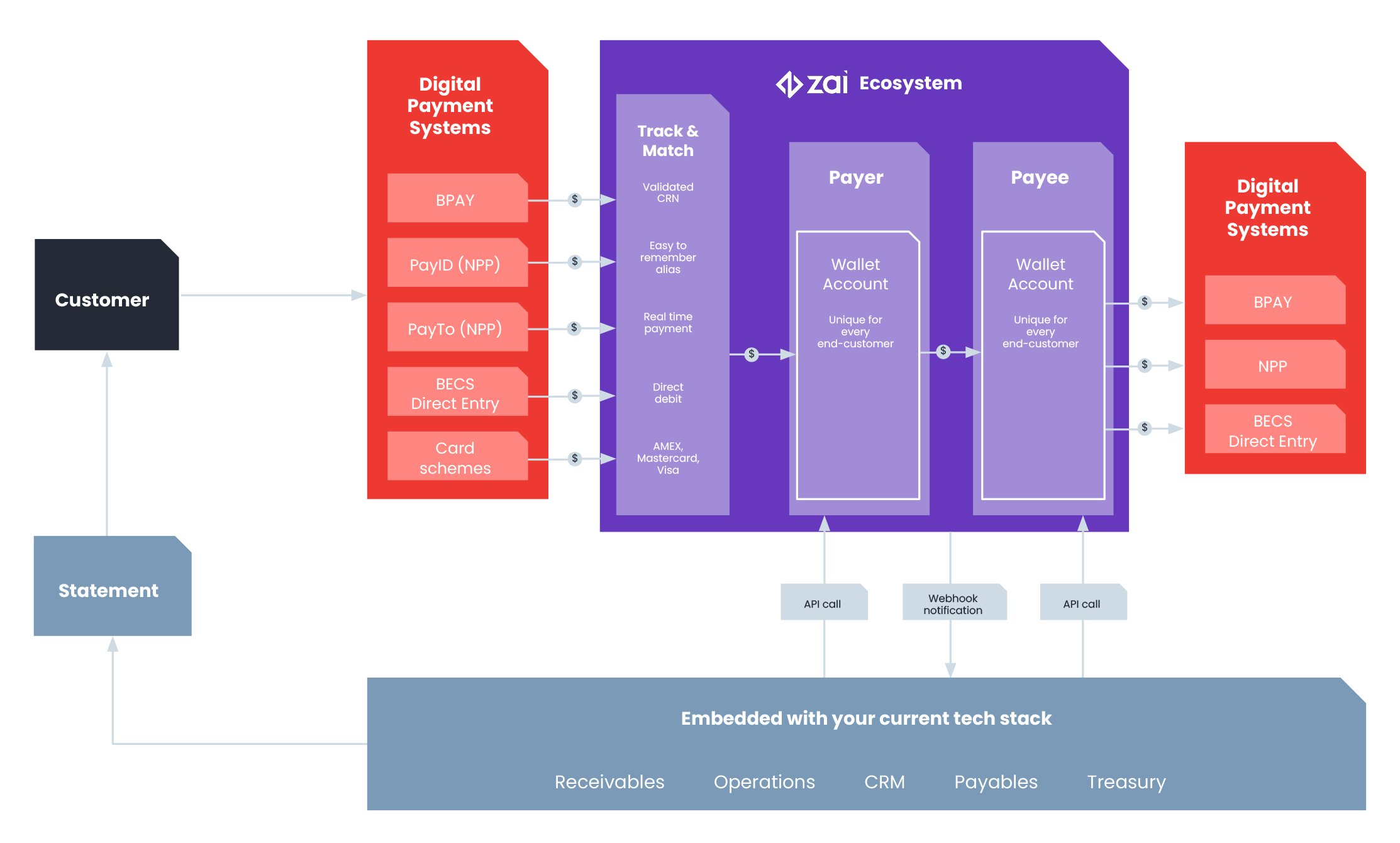

As you explore our sandbox, our experts model a customised payment flow system proposal for your business goals that you can seamlessly embed into your tech stack. While every proposal is different, all of our payment flow designs leverage continuous two-way communication via our APIs. That entails:

-

Sending you webhook notifications the instant a payment comes in or goes out.

-

Responding immediately to your API calls to move funds into the next step of its journey.

-

Repeating this process until that journey finishes.

Our proposal will show you which API interactions take place at each step of the payment flow – both from our system and yours. We’ll also show you how our wallet accounts work as a temporary haven for each end-customer’s funds before they move on. These individual end-customer wallet accounts can also act as a payment source depending on your business model. Each wallet account is unique and connected to an end-customer.

For automated tracking, matching and reconciliation, you can create virtual accounts that connect to each wallet. Since a virtual account acts as a reference number, it can instantly provide all the details for a transaction made via direct entry or the New Payments Platform (NPP). You can even assign unique PayIDs to each of your end-customer’s virtual account so they can send and receive funds by using a more easy-to-remember alias.

With Zai, you’ll have the tools to notify different teams depending on the payment event. For example, if it’s important to share reconciliation information at a certain step, then you can set up an API call or webhook notification for your ERP.

4. We help you test and deploy your new payment flow design

As soon as you finish embedding our payment flow design into your system, we’ll be ready to help you test it. We have you start with sandbox testing to ensure events, calls, responses and notifications work as expected.

Once we pass this step, we’ll move you into a production environment in a two-step process. First, your new payment system will go live with a small batch of end customers and with lower transaction volume. Our goal here is to ensure that the payment flow works as planned with your customers.

Upon passing this milestone, it’s time to go live across your entire platform. The entire process can go from start to finish in as little as a couple of weeks, letting you move quickly on transforming your payment experience. During this process and well into the launch of your new payment flow system, we’ll be there to support you.

5. We’re by your side as you grow

When it comes to your payment infrastructure, our goal is to act as your continued partner for success. Whenever your business model evolves, we’re ready to help you understand how your payment flow can evolve with it.

Anytime you have questions about payment infrastructure or want to validate an idea about a new payment flow, your dedicated account manager and local customer support teams are there to help.

3 mistakes to avoid when designing and implementing complex payment flows

Building a growth-enabling payment flow is way easier said than done. Getting it wrong can not only slow your growth plans but also overwhelm your finance, tech and customer success teams. These are some of the most common mistakes that we see companies making when trying to automate payment complexity.

1. Trying to use multiple payment providers and services to handle every payment need

Your customers will want to pay in the method they prefer. For you, that could mean accepting multiple payment options to meet those demands. On the surface, it could be tempting to patch together different payment service providers (PSPs) such as payment gateways and payment processors into your front-end to deliver on customer expectations.

Doing so, though, means adding complexity and sometimes even conflict to your backend. That ripples through all of your teams as:

-

Reconciliation becomes harder as you have multiple sources with different data standards to clean and then match against your ledgers.

-

Tech teams see their workloads increase as they need to patch together and maintain a collection of different and sometimes conflicting API sources.

-

Risks increase, requiring more in-depth management and monitoring of your payment system and protection of customer data.

Customer experience also suffers as processing times vary between payment service providers. That means your customers could see funds arrive and leave at different times depending on what payment medium they choose to use. Refunds also increase in complexity as the number of your providers increase.

More importantly, though, each payment service you use adds overhead costs that eat into margins. Before you know it, your payment system could be one of the costliest items on your balance sheet.

Instead of using several PSPs, find a full-suite provider like Zai that can enhance your scalability and consolidate multiple payment methods through one solution for a fraction of the cost.

2. Manually processing each step of the payment process

We’ve seen some impressive payment flow designs that, on paper, looked game-changing. Unfortunately, these systems required manual interventions at various stages of the payment journey. While hands-on processing can work when volumes are low, it becomes a major hindrance whenever payment transaction numbers increase.

In this case, the burden generally falls on the finance, tech and customer success teams as they try to work in unison to confirm, reconcile and troubleshoot payments. Customers will no doubt notice these issues as their payment experience will suffer.

Worse, manually processing payments is error prone. Aside from harming your customer experience (CX), losing control of payments or delayed reconciliation creates financial and reputational risks. Ultimately, manual payment processing creates far more problems than it solves.

Find a payment orchestration company that can help you automate the entire payment process to improve your customers' payment journey and your finance team's work.

3. Being responsible for your customer’s payment activity

If your payment design system acts like a financial centre, it could mean that you:

-

Move funds into specific online accounts.

-

Develop and maintain a ledger-like infrastructure for payments.

-

Hold customers’ funds for later use on your platform.

While this method can solve a lot of the trickier payment flow problems, it creates entirely new ones which have far-reaching implications for your business.

Acting as a financial institution means you’ll likely need to register as one in your local market. Doing so represents an enormous cost for your business. For one, you’ll need to bring in the appropriate risk and compliance teams to handle the monitoring and reporting of your online transactions.

Second, you’ll need to ensure that you’re meeting requirements for whichever licence or licences you hold. You’ll also need to ensure that your future growth plans won’t conflict with your current authorisations.

However, before you even get there, you’ll need to apply for the appropriate authorisations. That process is time consuming and can take many months to complete. During that time, you’ll be diverting valuable resources to your licensing instead of focusing on growing your business and market share.

Zai has the appropriate licences to help growing companies handle payments. Contact us today to find out how.

Who is Zai best for?

We’re experts at solving complex payment problems for growing tech-minded companies. While we can help a wide range of businesses (from fintechs and proptechs to utility companies), we work best with:

Online marketplaces

Online marketplaces thrive when volumes between buyers and sellers go up. The best marketplaces are the ones that can provide its customers with instantaneous feedback, including when:

-

A customer tops up their account.

-

A buyer makes an online payment to a seller on the platform.

-

Sellers transfer funds out to themselves.

Our payment solutions can provide this and more. As a merchant account provider, Zai can give you PCI DSS Level 1 compliance to accept online card transactions from cardholders. You’ll have connections to payment gateways to accept debit card and credit card payments (Visa, MastercardⓇ and American Express).

With Zai, you and your customers can also make top-ups with preferred payment methods, such as real-time NPP payments (e.g., PayTo), which can provide instant reconciliation of customer accounts.

You’ll even have better payment flow management for crediting sellers and yourselves for commissions and fees.

PropTech platforms

We’ve helped some of Australia’s fastest growing proptechs turn what was a spreadsheet-driven industry into a tech-powered one. Our payment flow designs let these platforms automate important parts of property management, including:

-

Rent payment collection. Set rules and collect rent and other funds from a variety of payment options.

-

Split payments. You can segregate funds for different stakeholders, such as building managers and common funds.

-

Multi-party payments. Pay out money to landlords and other beneficiaries.

Our tools let proptechs set the rules they best see fit, enabling them to build better CX while innovating a crucial yet traditional industry.

Lenders

Online (micro) lenders help borrowers quickly access credit. Our payment flow tools can let lending platforms immediately credit borrowers with funds, regardless of the time of day. These tools are particularly powerful for earned wage access, letting employees pull their salary before payday.

Discover how we helped the earned-wage-access app Beforepay enhance their value proposition, resulting in a boost in customers and a 4.9 rating on the Apple App Store.

Investment platforms

Fintechs, such as investment platforms and exchanges, often have complex and costly software development because of their high-demand funding needs. They want their customers to top up their accounts as quickly as possible to take advantage of any market opportunity.

We can help these companies by:

-

Automating the funding process.

-

Providing instant notification to the platform once a customer makes a top-up.

-

Helping to store funds for customers to trade with.

-

Collecting fees and commissions.

-

Making payouts seamless.

Our payment flow design ensures that all of these steps happen without human intervention, keeping customers trading as much as they see fit.

Startups

Our payment tools let startups quickly roll out payment infrastructure to support their ambitious visions. With our help, startups can implement payment flows that rival or even exceed those of their established competitors.

We know how limited early-stage startups are with their time and IT resources (we got our start as one over a decade ago). Our APIs make it easy for developers to quickly roll out payment products. Additionally, we’ve helped many startups during our 10+ years. Our experts can help guide tech teams through our reference documents and products so that they can build efficiently. That way, you can quickly integrate payment flows and other infrastructure, letting you focus on interface and CX improvements.

How Zai helped a growing Australian B2B marketplace conquer their payment system needs

Ordermentum is a B2B order management platform focused on helping buyers and sellers in the hospitality industry trade more efficiently. They connect hotels, restaurants and cafes with produce suppliers. Their payment flow generally worked like this:

-

The restaurants and hotels would top up their accounts to make purchases.

-

Once the platform confirmed the top-up, the buyers would purchase produce from suppliers.

-

Ordermentum would then credit the suppliers with the proceeds once order delivery took place, while also taking a commission for themselves.

As their platform grew, they realised that managing payment flows on their platform was getting increasingly more difficult, especially since payment collection couldn’t be confirmed quickly and reconciling positions was a juggling act. Realising that their growth plans depended on how well their payment system could perform, they reached out to us for help.

Immediately following their first call, our payment flow experts got to work reimagining Ordermentum’s payment system. The proposal that came out would be game changing. Purchasers could now pay with any medium they saw fit, including:

-

Bank transfer.

-

BPAY.

Since we work with APIs, we could notify Ordermentum as soon as a payment entered its ecosystem. That way, they could credit the buyer immediately. To make that process even easier, Ordermentum added our wallet account feature, which enabled them to separate funds for each buyer and seller on their platform. This solved two major headaches for them: not only could customers immediately transact with each other, but they could also instantly reconcile balances. Now, both the finance department and customers knew exactly where their money was.

To help automate commission payouts and help sellers pay their deliverers, Ordermentum implemented our split payments. This tool let them automatically split funds within the payment journey so that commissions get credited and onward recipients get their money without manual intervention.

Finally, sellers could take advantage of the same payment tools as buyers, letting them send funds off the platform instantly and with ease. Thanks to our payment system design, Ordermentum was free to focus on what really mattered to them: making the Australian food and beverage industry a more efficient and smarter place.

Transform the way your payment system works with Zai

Payment flow design is one of the key drivers of any growth or scale up strategy. Depending on how you handle this often complex process will determine how fast you can grow and how quickly you can move to meet your customers’ growing demands.

We’re leading experts in creating bespoke payment flows for growth-minded companies in Australia. Contact us today to see how to design the payment system you envision so you can free up your talent to do what it does best: build products your customers love.

This information is correct as of April 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment. This article is purely for general information purposes.

About the Author

Hami Shoghi

Senior Account Manager

A seasoned fintech specialist who helps fast-growing platforms solve complex payment challenges through tailored, scalable solutions. With a background in startups, SaaS, and business development, he brings a consultative approach that blends technical insight with commercial impact.