As a CPO or product manager at fast-moving online platforms, you might struggle with creating greater efficiency around your incoming payments. You might be running into:

-

Many verification issues when customers try to pay or top up their accounts, but input the wrong bank details.

-

Fraud-related legal issues for mistaken payments made to scammers imitating your company.

-

Slow traditional payin cycles due to the nature of the banking system, especially when you can’t accept card payments due to industry regulations.

-

Poor customer experience when clients must go off platform and use cryptic bank account information to make inbound payments.

-

Difficulty matching payments to customers and services because of limited description fields in traditional bank transfers.

-

Time-consuming research on better options that don't require ages to set up.

As an easy-to-remember alias for a bank account, PayID can provide a modern solution to these problems by using it with real-time payments on the NPP.

At Zai, our API allows tech-driven platforms to accept payments via PayID. With it, companies now have a low-hassle way to reduce reconciliation, speed up pay-ins and enhance customer experience.

In this article, we look at:

Ready to get a PayID API up and running on your platform? Contact us now to get started.

How Zai's PayID API works

We’re a local tech-driven payments and orchestration company with an API that allows Australian businesses to access PayID features. Via our RESTful API, you can use PayID for real-time payments via the New Payments Platform rails, on three different levels:

-

Simplify real-time payment workflows when accepting NPP payments.

-

Create a custom PayID for each customer on your platform.

-

Easily identify and reconcile incoming payments.

Let’s take a look at each functionality in depth:

Simplify real-time payment workflows when accepting NPP payments

Zai supports real-time payments via the NPP network. When your customer makes a payment from their NPP-enabled bank, we track, match and reconcile these payments instantly within Zai's ecosystem.

We can help you match an incoming NPP payment to a specific customer wallet account in two ways:

-

Via the PayID.

-

Via a virtual account number connected to a wallet account.

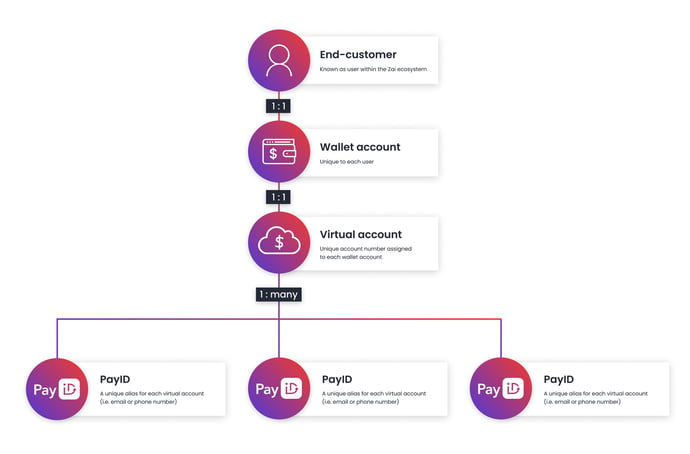

Since both of the above are unique identifiers, the money coming in goes to a corresponding wallet account (which has already been assigned to each of your end customers on the platform).

Create a custom PayID for each customer on your platform

As an authorised participant on the PayID network, we’re able to create new PayID addresses on behalf of our clients. Using our register PayID function, you can quickly create PayIDs specific to your platform for each one of your customers (more on that in the next section).

To do so, you simply need to post the payload with:

- The PayID in email address format such as “customer@mydomain.com.”

- The PayID name that will be searchable on the network.

- The legal name of the address holder.

If the information is correct, you’ll receive an acceptance response. From that moment on, your customer will be able to take full advantage of their new PayID to send and receive funds on your platform. In theory, there’s no real limit to the number of addresses allowed on the network. That means, with our API, you can scale your business without worrying about running into any PayID limitations.

Easily identify, match and reconcile incoming payments

Our PayID API incorporates both calls and webhooks. With the latter, you can directly find out the status of a PayID address without having to send us a GET request. In turn, you can inform your customers and internal teams if a PayID is active, pending, or has issues.

To reconcile NPP payments, we use unique virtual accounts that are assigned to each end-customer. The virtual account is a BSB and account number that helps you track and reconcile incoming funds.

Your end customer’s banking portal will recognise the virtual account as a valid account number (as opposed to a customer reference number or CRN, which a bank would not recognise or be able to validate).

To simplify things even further for your customers, you can also assign an alias (e.g., email address) associated with your end customer’s virtual account so it’s easy for them to remember. When your end customer searches for the recipient of the payment via the email address and it appears, they are validating the virtual account number.

This means inbound payments match automatically, with no manual reconciliation needed. You’ll also get instant notification of payment received via an API.

We’re just scratching the surface of what our payment orchestration and RESTful APIs can do. Feel free to read our API guides and reference database to learn more about our technical features.

The benefits of using Zai’s PayID API

Now that we’ve covered how our PayID API works, let’s explore some of its features and benefits, as well as how it fits into our wider product suite to help you build your ideal payment infrastructure.

Zai’s API makes it easy to find (and validate) PayID addresses

Our PayID API connection enables you and your customers to search the entire PayID network with one API call to quickly validate an email address. This feature improves your customer experience in two ways. For one, it enables you to reduce payment failures and frustration by detecting non-existent email addresses. Additionally, your customers can search for PayID address details to ensure there are no typos before making a payment.

While your customers will probably need to verify this information with their counterparty, the in-platform check gives them a useful, first-step resource.

Automatically give each customer a unique PayID at onboarding

Speaking of great customer experience, wouldn’t it be great if you could give each one of your customers a PayID linked to their account or wallet on your platform? That way, they could directly top-up their accounts or make peer-to-peer (P2P) payments without leaving your app or website.

Our PayID API enables you to do exactly that). Here’s how it works:

-

Once you've onboarded a new customer, you send us their email via API.

-

We create a contact and register a PayID with the email address received. This only takes a few seconds and you can set up a webhook to notify you once the registration process is complete.

-

We assign a wallet for each of your customers linked to their PayID address. Each of your customers will receive a wallet account that enables them to receive and pay funds with.

We explain the technical ins and outs of PayID in our API guidebook. We recommend checking it out to learn more about this great feature.

Our PayID API product solves a couple of major pain points that many growing platforms struggle with. First, creating a PayID for each of your customers simplifies reconciliation and reduces customer service loads, since PayIDs are both unique and immutable. Outside of a payer using the wrong address for one of your customers, it’s impossible to lose funds within your system since the PayID is linked to each customer.

Second, our wallet accounts give your customers the ability to better manage the funds they keep on your platform. Our APIs will keep them up-to-date on any changes to their payments as they happen.

As we’re able to connect to multiple payment networks in Australia and beyond, your customers can send their funds directly from their wallet to outside parties, whether it be via real-time payments using PayID or many other channels.

Streamline workflows for quicker payments and reconciliation

With our webhooks, you’ll receive a notification as soon as a PayID-facilitated payment enters our payment ecosystem in your favour. This instant connectivity will enable you to immediately update your ERP, minimising the time your finance teams spend reconciling your books.

More importantly, the webhook can also trigger onward processes in your payment workflows and customer journeys that create better customer experiences. It’s no secret that outstanding CX is what helps great companies build repeat business. Automating payment journeys and providing instant feedback help you build trust with your customers. Zai’s PayID API and other RESTFul API payment connections give you a powerful tool to do so.

Access a broad suite of payment solutions with one RESTful API integration

We’ve been working for years developing our payment API tools. Over that time, we’ve added:

-

The ability to create custom flows that enable you and your customers to split payments.

-

Rich financial data and analysis.

-

Multi-party payment flows.

-

Automated fraud and risk controls to keep you safe.

You’ll also have access to multiple payment methods with Zai, including:

-

BPAY.

-

Debit and credit cards.

-

Wire transfer.

These features are available through our RESTful API. As a PayID API customer, you’ll be able to add these functionalities as you see fit for your needs, with minimal disruption to your payment stack.

Want to start using PayTo? Contact us today to learn more.

Quickly implement PayID via API on your growing platform with our experts’ help

Zai’s PayID API offers online platforms a quick and comprehensive way to use PayID for payment transactions. Our implementation process starts with a technical call with one of our experts where we learn about your real-time payment needs.

Once we’re on the same page, we get to work crafting a proposal, while simultaneously giving your tech lead keys to our sandbox.

Once you’re satisfied with our proposition, we get to work helping your developers implement our RESTful API and schema into your stack.

Depending on your requirements, we can quickly roll out an omnibus PayID schema for your platform. Under this model, you receive one PayID address for your client-facing operations. Through here, your customers can route payments via PayID into your platform. Once the payment hits your system, you’re free to manage those funds as your business model sees fit.

Receive support from our team of complex payment solution experts

We like to think of ourselves as less of a payments tech company and more of a payment orchestration and solutions provider. Instead of pushing an out-of-the-box solution, we focus on building a custom solution that will help you solve your specific payment challenges.

After implementing the solution, we’ll be right there to help solve any other issue that arises along the way. As you grow, we’re there to ensure your payment infrastructure helps meet whatever demands your customers might have.

How Zai’s PayID API helped an Australian investment platform keep users transacting

Cryptocurrency markets run 24/7, which means their customers want to be able to trade when they believe the market is in their favour. A leading crypto exchange platform that enables users to buy, sell and hold cryptocurrencies came to us because enabling their clients to fund their accounts as quickly as possible was a major pain point. Given the nature of their business, they couldn't readily use credit cards to do so.

Initially, they turned to direct debits and bank transfers so customers could fund their trading activity. However, this solution came with a few major drawbacks.

For starters, direct debits and transfers don’t necessarily clear instantly, which could leave their customers sitting on the sidelines as their trading opportunities float away.

Second, setting up a direct debit or executing a bank transfer required their customers to go off platform, open their banking app, enter the crypto exchange's BSB number and a transaction reference, and then send the funds. Aside from forcing their customers to leave their website, the company's reconciliation and customer support teams were constantly tracking down top-ups that had the wrong or no reference number and then crediting them to the right account.

Finally, their customers wanted a way to move their profits from the app to their external bank account. Using direct debit was useful for setting up a simple route into the crypto exchange but not out of the platform. For that, customers had to execute a bank transfer, which could take up to a few days to settle.

Zai’s PayID API to the rescue

Unsatisfied with this setup, the crypto exchange reached out to Zai to fix these shortcomings. Zai’s payment experts sat down with their product and tech leads to brainstorm a better and more customer-friendly payment service.

PayID quickly came to the forefront of this session. We recommended that they start accepting real-time payments via the NPP first so they could then implement a PayID system on their platform for a better end-customer experience. The company agreed and following some technical design work by Zai’s experts and the company adopted our PayID solution.

The product is straightforward. The company uses Zai’s PayID API to generate a unique PayID for each of its customers. For existing company clients, we created an ID and added it to their profiles. For new clients, Zai generates a PayID automatically at onboarding.

The PayID followed a simple email format as a unique identifier that was immediately clear to anyone who saw it, consisting of a unique name followed by @payid.cryptobrand.com (for example, “sample.name@payid.cryptobrand.com”).

The company's customers can immediately and effortlessly top up their accounts at no cost using their PayID via Osko’s instant payment network and Zai’s RESTful API. Their customers are also free to use the same setup in reverse so that whenever they want to withdraw funds, they can do so instantly without having to leave the platform.

Thanks to the PayID structure Zai helped them create, the company's users no longer need to put in a reference number to top up accounts since the PayID is fully unique. Reconciliation issues have dropped, while customer experience went up, thanks to Zai’s PayID API and team of experts.

Use Zai to get a PayID API up and running on your platform in no time

Zai is the first payment company in Australia to offer a comprehensive PayID API that meets the demands of tech-minded companies. With the help of our experts, you can implement PayID as well as a host of other powerful payment tools via our RESTful APIs.

If you’re ready to learn more about how we can help your growing platform implement a PayID API in your stack, we’re ready to talk. Contact us today to get the conversation started.

This information is correct as of March 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes.

About the Author

Hami Shoghi

Senior Account Manager

A seasoned fintech specialist who helps fast-growing platforms solve complex payment challenges through tailored, scalable solutions. With a background in startups, SaaS, and business development, he brings a consultative approach that blends technical insight with commercial impact.