We’ve been helping businesses manage their direct debits for over 10 years, and the most common concerns we often encounter include:

-

Integrating direct debit with multiple payment methods is complicated, time-consuming, and requires a lot of work if done in the normal way.

-

Direct debits are costly for transactions of low value and are time-consuming to manage.

-

Working with direct debits may result in less flexibility and a slower user experience when compared to card payments.

At Zai, our direct debit API works for businesses big and small across countless industries. In this article, we’ll outline everything you need to know to help you make the switch, including:

Note: if you’ve done all the research and you’re ready to invest in a direct debit API, get in touch with us to help you set up everything you need.

How Zai's direct debit API works

We're one of the very few direct data providers out there that offer direct debits via API. With our API, we’ll create a fully automated, tailored solution for your business that fits easily into your current setup. We also offer a full suite of payment solutions beyond direct debits.

You’ll benefit from reduced costs, overheads, errors, and processing times. Your customers will benefit from a much smoother experience interacting with you.

Let’s quickly break down what that means in practical terms.

1. Fully automated direct debits which save you time and costs

Traditionally, direct debits have been one of the more cumbersome, slow, and inefficient ways to manage payments. They require a huge amount of manual labour and you’re at the mercy of both your customers (to maintain the necessary funds in the customer’s bank accounts), and the banks themselves (to process everything correctly at their end).

Plenty of direct debit payment solutions have tried to address these issues. But most still rely on manually compiling lists of transactions and sending various files back and forth between the multiple entities involved.

Instead, our API streamlines everything. The API compiles lists of transactions to be processed every day and cross-references these with data from your customers’ banking providers and software before initiating any transaction.

This doesn’t just reduce the number of failed transactions (and their costs), but also cuts down on the time and labour needed to manage direct debits. The API works round-the-clock, never takes time off, can send notifications via webhooks when a payment is processed and doesn't make human errors.

The increased efficiencies of using a direct debit API also lower your operating costs by reducing the number of errors, security breaches, and similar issues that result from doing everything manually.

You can reinvest the time and resources Zai’s direct debit API saves you to focus on more important things – like growing your business and keeping your customers happy.

2. A full-stack payment solution so you can manage payments from one place

At Zai, we understand how frustrating it can be to manage so many different payment solutions. It’s probably the main thing holding you back from adopting a direct debit API – yet another payment process to manage!

We’ve already explained how the API will save you time and resources managing your direct debits, but that’s not all: you can also integrate with your other payment solutions.

By working with Zai, you can also accept other payment methods such as BPAY, credit card payments, real-time payments and PayTo. You can add our API to your pre-existing payment stack (we’ll help with that).

You can stop managing every payment type and related functionality individually, dealing with a dozen different providers and constantly playing “mix and match” with your payments. We’ll help you create a simple, easy-to-manage payments hub that takes care of everything in one place.

But if you just want help with your direct debits, that’s okay. Get in touch, and we’ll lay everything out for you to get started.

3. A scalable solution that grows with you

Another concern to adopting payment solutions we also need to address: any direct debit API needs to grow with your business.

The last thing you need is a payment solution that starts crashing because you’re suddenly onboarding hundreds of new customers, and it doesn’t have the processing power to meet the demand.

Our direct debit API is lightweight and agile. It can be quickly scaled to manage a massive amount of data and transactions. We’ve worked with businesses in fast-moving industries (including crypto, proptech, fintech, charitytech, and many more), generating millions of dollars in transactions, and growing, in some cases, more than 10x a year.

We build scalability into the API to ensure it never slows you down as you grow.

4. A personalised and human approach so you won’t have any nasty surprises

Just because we’re helping you switch everything over to a fully automated solution doesn’t mean we’re completely hands-off – quite the opposite.

We understand that implementing an entirely new payment solution across your company can be really tough. So, we’re available every step of the way to guide you and your team through the whole process.

Once we start your onboarding, you’ll work with a dedicated support team based in Australia. We won’t just work to understand your specific business needs, but also the nuances and quirks of your industry, culture, and customers.

Your Zai support team will be on hand whenever you need us to quickly resolve any issues that arise so there’s no impact on your customers. And when you’re ready to grow and need help doing so, we’ll be here, with a host of complementary services and solutions.

Who can (and should) be using a direct debit API?

In a nutshell, any large business or organisation that processes lots of payments daily from numerous sources, and wants complete control over their customer relationships and payment configurations.

Direct debit APIs work best for businesses that have outgrown off-the-shelf software solutions, and for whom managing the process manually is no longer feasible. If you've already invested in customised solutions for your ERP or CRM, you understand the difference it can make in managing your business' backend. A direct debit API is no different.

The nature of your business and the size of your customer base probably means you’re accepting multiple payment methods simultaneously – bank transfer, credit and debit card, BPAY – and performing a delicate balancing act managing them all. So, your direct debit solution also needs to easily integrate with, and sit alongside, all of these channels.

But most importantly, everything needs to happen smoothly, so your customers can pick the best payment solution based on their circumstances, switch to a new one if necessary, and not experience hiccups along the way. A direct debit API is the best way to achieve all this and more.

Some examples of businesses we’ve seen successfully adopt direct debit APIs include:

-

Utility companies processing bills from customers and making direct credit payments to contractors and suppliers throughout a national network.

-

Franchise businesses, such as gyms, collecting payments from branches in different cities.

-

Large charities and NGOs collecting one-off and recurring donations.

-

Online marketplaces, especially those offering digital goods and services, and subscriptions.

-

Remittance platforms.

-

Cryptocurrency exchanges.

-

Investment, trading, and FX brokers.

But to show the true power of direct debit APIs, let’s take a quick look at an industry we’ve worked with plenty of times: property management.

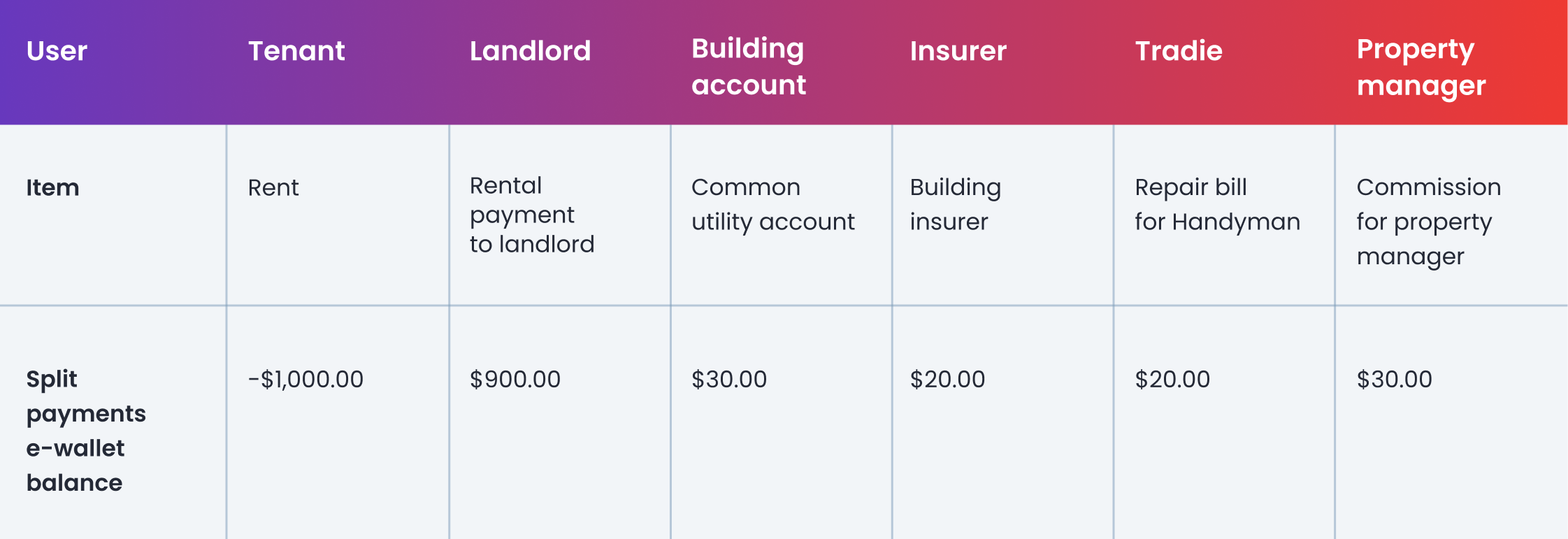

How property management companies can use a direct debit API

Your average property management company is incredibly complex, with many stakeholders, customers, and contractors. These include:

-

Tenants.

-

Landlords and investors.

-

Service providers (cleaning, maintenance, etc.).

-

Utility companies.

-

Financial institutions (loans and mortgage providers).

-

Local government.

-

Insurance providers.

-

And so on.

A large property management company could have relationships with hundreds of businesses and thousands of individuals.

Each one is going to process transactions differently. Furthermore, the property industry still relies heavily on direct debit requests as the standard payment solution – many operators in the space don’t allow credit and debit card payments, for example.

So, if you’re a fast-growing property management company or marketplace, you need a simple, reliable, and scalable solution. It needs to be easy for everyone to use, whether they’re a new tenant renting their first home, or a multinational bank managing billions of dollars in transactions every day.

And it needs to be flexible – the property market is incredibly fickle, with tenants constantly moving in and out, and everyone involved working on different schedules, payment terms, and so on.

Zai’s direct debit and split payment API meets these challenges by automating the entire direct debit payment flow and integrating it with a broader payment infrastructure. You can easily set up and manage direct debit transactions from a multitude of sources, create rules, and collect and disburse payments between every stakeholder with ease.

.png?width=2991&height=1321&name=many-to-one_2%20(2).png)

Property is just one industry we’ve worked with to create tailor-made direct debit APIs for businesses at various stages of growth. While the solution we build is always unique for each business, the approach is always the same: making direct debits easier by reducing manual efforts and costs and by streamlining an automated reconciliation process.

When to use an API vs a direct debit provider

For some businesses, working with direct debit providers that offer ready-made dashboards will be enough. But for some, an API might be better.

Here’s a simple exercise to help you decide:

-

Direct debit dashboards: These are good for companies that have a robust payment system in place and process direct debits occasionally, say, only once a week or once a month. The volume of direct debits doesn’t justify investing in an API solution currently.

-

Direct debit API: Due to the high volume of transactions you manage, you’ve built a proprietary payment system, customised to your business needs. You need to integrate direct debits, but you don’t want to compromise on control and configurability.

And if you’re still not 100% sure, we’re here to help. Get in touch, and our team of experts will listen to your specific needs. If we feel a direct debit API makes sense for you, we’re available to set one up. If not, we can still guide you on the best next steps for your business.

A more modern approach to direct debits

At Zai, we’re bringing direct debits into the 21st century by automating the whole process, reducing risks, cutting costs, boosting security, and seamlessly integrating direct debits into more modern payment solutions and business models.

Speak to one of our experts to learn how our direct debit API can improve your cash flows, help you retain customers, and much more.

This information is correct and updated as of November 2022. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial and legal advice before making any form of investment or significant financial transaction. This article is purely for general information purposes.

About the Author

Hami Shoghi

Senior Account Manager

A seasoned fintech specialist who helps fast-growing platforms solve complex payment challenges through tailored, scalable solutions. With a background in startups, SaaS, and business development, he brings a consultative approach that blends technical insight with commercial impact.